Description

Here’s a quick timeline of the history of credit cards.

-

- 1950: Diners Club issues the first charge card

-

- 1958: Bank of America issues the first general-purpose credit card that offered a “revolving credit” feature

-

- 1958: American Express Company issues a travel and entertainment payment card

-

- 1969: Magnetic strip standard is adopted in the U.S.

-

- 1976: Bank of America spins off BankAmericard and joins with other banks to create Visa

-

- 1979: Mastercard brand comes into existence, formerly the Interbank Card Association and Master Charge

-

- 1986: As a subsidiary of Sears, Dean Witter Financial Services Group launches the Discover Card

-

- 2015: EMV chips become standard to help protect buyers against fraudulent card transactions

After Diners Club issued its first charge card in 1950, the payment card began evolving into what we know as the credit card today. In 1958, American Express Company jumped into the payment card scene and launched its first charge card.

In 1958, Bank of America launched BankAmericard. This paper card could be considered the first modern credit card. The BankAmericard came with a $300 limit and was the first credit card to offer revolving credit, which gave people the ability to carry a balance. In 1970, BankAmericard was spun off into National BankAmericard, Incorporated, an interbank card association that issued and managed credit cards. In 1976, National BankAmericard, Inc. became Visa.

In 1979, Mastercard was formed. Before it was called Mastercard, the company was formed as The Interbank Card Association in 1967. It then rebranded itself as Master Charge in 1968 before its final change in 1979.

And finally, we have the Discover Card, which was launched nationally in 1986 by Dean Witter Financial Services Group, Inc. which was a subsidiary of Sears.

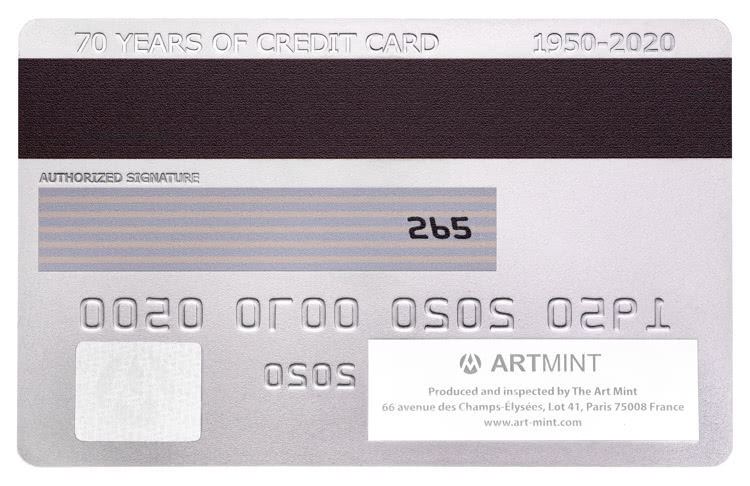

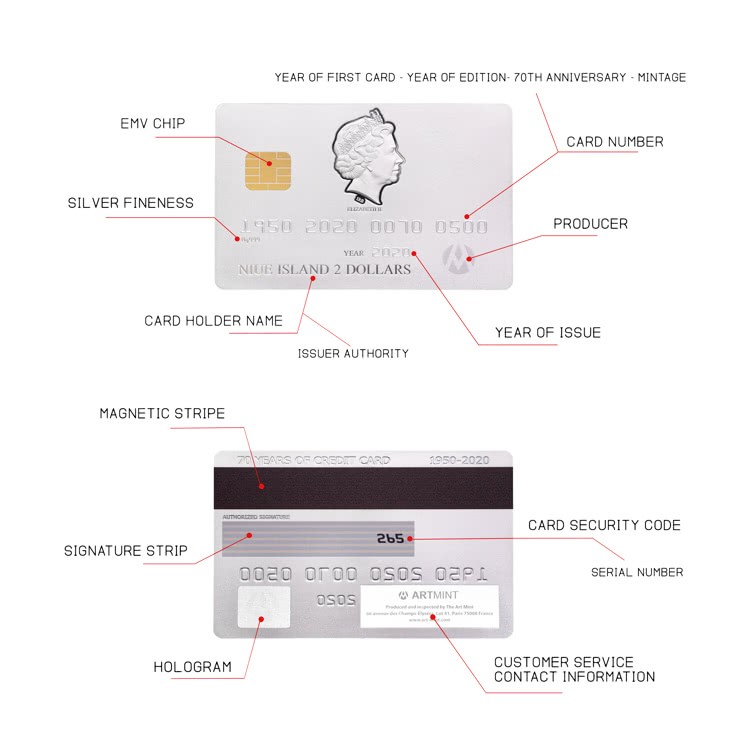

Credit cards didn’t always have magnetic strips or EMV chips. Before magnetic strips, machines would take imprints of credit cards to capture the information needed to process payments. The copy would be sent to a processing center where a clerk could enter a person’s credit card account information into a computing system.

In 1969, IBM helped develop a standard for magnetic strips that would eventually be adopted internationally. This standard allowed credit cards to use magnetic strips to transmit card information worldwide.

Until recently, magnetic strips were the most common way of storing and transmitting card information. A new technology, called the EMV chip, aimed to make credit card transactions more secure. These chips generate unique, one-time codes to approve transactions and are considered more secure than static magnetic strip information.